Poland

Contributed by Sylwia Szostak

Updated July 2022

Key Takeaways

Netflix is the most popular streaming service, although Disney+ is expected to quite quickly threaten Netflix’s leading position in the market.

Subscriber estimates suggest that many viewers take out Netflix subscription in addition to, rather than as a replacement for, their cable/satellite TV service.

Poland is considered a tempting market for streaming services and the most important market for Netflix in the CEE (Central and Eastern Europe) region. Its capital, Warsaw, is set to become Netflix’s regional hub.

Netflix’s ties with Poland go beyond local commissions and include investment in local creative talent and collaboration with local institutions

Market

According to Nielsen Media, the total number of TV homes in Poland stood at 14.28 million as of the beginning of 2022, marking 0.4% increase from the previous year. The stable and very high number of TV households in Poland is a sign that the TV set is still the basic equipment in the homes of Polish viewers. Amid media fragmentation, linear TV still has the broadest reach. In terms of channel performance, nation-wide free-to-air broadcasters such as commercial operators TVN and Polsat, and the public service broadcaster TVP1 and its sister channel TVP2, are the most heavily consumed services. According to Nielsen, linear TV consumption in Poland stood at 4 hours 30 minutes for individuals in 2022, which demonstrates that linear TV viewing has been steadily increasing year on year.

But despite the steady viewing time of linear TV, viewers are spending more and more time with a wider selection of media outlets. As a result, it is harder for linear broadcasters to attract wide audiences. In 2021, there were only 11 broadcast programmes that managed to attract 5 million viewers threshold, and 10 of them were sports broadcasts. Linear still provides massive reach and scale and immediacy valued by viewers especially in terms of live sports.

Over two-thirds of homes in Poland receive their TV services via cable or satellite. According to figures produced by Omdia there are 11.5 million pay-TV subscriptions out of 40 million pay-TV subscriptions in the whole Central and Eastern Europe (CEE) region, making Poland the biggest pay-TV market in the CEE region. Poland has a resilient pay-TV sector despite the growth in the online video subscriptions. Cord-cutting is not yet a significant tendency, as, according to Wavemaker, if pay-TV viewers were to subscribe to an additional VOD service, they would rather unsubscribe from a VOD provider they have been subscribing to rather than cut-cord and resign from pay-TV cable or satellite. This proves the complementary nature of VOD services in Poland, which serve as a certain addition extending video offer.

Pay-TV operators’ strong position in the Polish market relies on the fact that, Polish viewers can't use OTT services without the broadband they offer. Infrastructure is a significant problem facing media-on-demand services in Poland and for the time being, fiber is best pulled from pay-TV operators’ ubiquitous urban access networks. An additional strength of cable operators is that the subscription they provide is a broader range of content and services than any single online video service. Pay TV is much more than linear TV – it is a service bundling of internet, multifunctional set-top boxes, catch-up TV, telephony, and energy. To minimise subscriber churn, pay-TV services accentuate their value and user experience over an online video service to retain existing subscribers.

For cable providers, partnering with the OTT services is another strategy to fight off cord-cutting and offer a major value-add for customers to sustain cable subscriptions. Collaboration with Netflix or HBO Max is similarly used for promotional purposes by telcos such as Orange, T-Mobile and Netia to encourage the take up of their broadband and mobile usage of data plans. Cable access is considered essential to an extent that newly built blocks of flats all have fixed cable access and the cost of connection is usually included in the maintenance charge. Hence, cord-cutting in Poland is unlikely to gain the pace that is taking place in the US in the near future. In 2022, 30% of those interested in subscribing to Disney+ would prefer to do so via their cable provider.

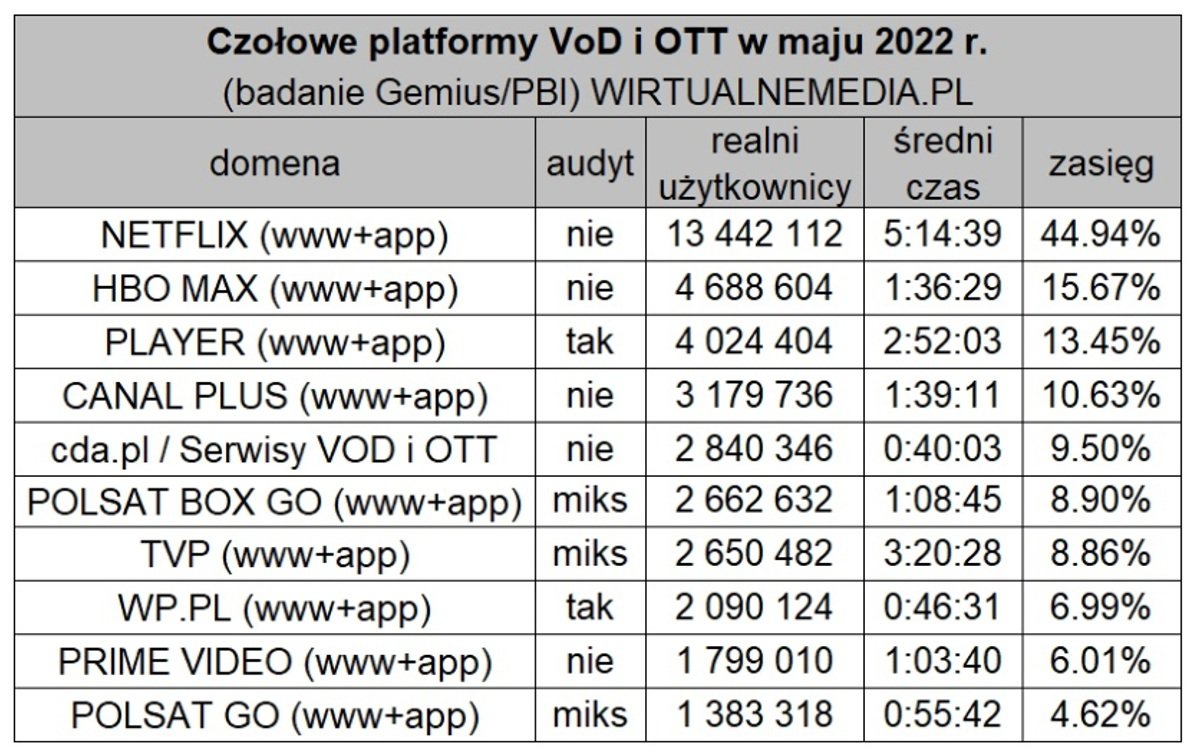

Since debuting across the region in early 2016, Netflix has revolutionised the way viewers consume content and paved the way for the launch of other on demand services. Netflix dominates the Polish online video market for the time being and, among online viewers, Netflix is considered the best producer of TV shows[1] but competition in the online video sector is set to intensify in 2022, giving consumers more choice and flexibility to cancel a subscription in favor of a new one if it isn’t user-friendly or lacks the content they want to watch. HBO Max launched in March 2022 but the biggest threat for Netflix is expected to come from Disney+, which launched in Poland in June 2022. Even before the marketing campaign for the service launched, 34% of people who already streamed content online demonstrated interest in subscribing to Disney+. Additionally, SkyShowtime (Viacom CBS & Comcast Universal) is expected to launch in 2022 with over 10,000 hours of content from the likes of Sky, Universal Pictures, Showtime, and Nickelodeon, increasing the pressure on local and regional pay-TV and Netflix. For the time being (2022), Netflix is the leader in all categories, with the biggest advantage in terms of user numbers (all Internet users who visited a given service at least once in a month). In May 2022, Netflix had 13.44 million users (website+app), which amounts to almost three times more users than HBO Max (4.69 million) with equal advantage over domestic service Player (4.02 million). Each user spent on Netflix an average of more than 5 hours per visit.[2] Prime makes it to top ten streaming services in Poland but is nowhere near the popularity of Netflix or HBO Max, with less than 2 million users in May 2022. Poland’s BVODs, such as Player, Polsat Go, Polsat Box Go and TVP VOD are amongst the most popular services in Poland but similarly lag behind the American streaming giants. Scandinavian streaming platform Viaplay that operates in Poland since August 2021 and, for the time being, focuses on live sports has on average a little more than a million users monthly.

[3]

Partnerships with pay-TV operators and telcos, who provide established trusted relationships with consumers, has been key to allowing online video services to gain a foothold in the Polish market. As streaming continues to establish itself as an important way that people consume media in Poland, capturing the attention of audiences becomes an ongoing challenge for both the established streaming giants, their regional competitors as well as new entrants. Competition of VOD in Poland is leading to fragmentation of the streaming market of video services, and it is no longer practical or cost effective for Polish users to be subscribed to every service. This makes capturing and retaining audiences crucially important. In a market where the pay-TV sector remains healthy, aggregation partnerships can improve consumer awareness of online video services and make it easier for consumers to take up a new online video service while being able to keep the pay-TV service that they are accustomed to using.

For instance, HBO Go, on its launch in 2010 was initially tied to cable subscriptions[4] and did not become a fully stand-alone direct to consumer service until 2018,[5] finally giving users access to HBO’s entire library of original series, films and documentaries. Despite launching its OTT service, HBO Go continued to be available through local distribution partners with TV, internet or mobile packages. When Netflix launched its service in Poland in 2016 it immediately signed an agreement with T-Mobile, its first local partner in Poland, allowing members to pay for Netflix through their T-Mobile account. This strategy of collaborations between pay TV operators and telcos and VoD services is a significant one, not only in Poland but in the whole CEE region.

Each of the linear broadcasters has a VOD platform in their portfolio, which offer Hollywood blockbusters and foreign TV series combined with popular local television formats and domestic series through either subscription-based packages without commercials, ad-supported services or transactional VOD services. The Polish public broadcaster TVP offers their extensive library of content in an ad-supported mode through TVP VOD or on pay-per-view basis. TVP also offers subscription-based access through a service called Strefa Abo for a monthly fee of PLN10 (2USD). For those users who pay the radio & TV licence fee this service is free of charge. The owner of commercial linear channel Polsat – Grupa Polsat Plus, a media and telecommunication giant -- owns two online TV services: subscription-based Polsat Box Go with a monthly fee of PLN30 (7USD) and ad-supported Polsat Go.[6] Poland’s second major commercial linear broadcaster TVN, part of the Warner Bros. Discovery family, is accessible online via Player, which operates as ad-supported or subscription-based streaming service. Player offers its users access to TVN’s impressive library of domestic series and local entertainment format adaptations, as well as the content library of discovery+.

Broadcaster VoD platforms were initially designed for TV catch-up viewing, but in recent years linear broadcasters have been investing in online services as it is essential to offsetting the anticipated declines in broadcast revenue resulting from the ongoing transition to online viewing. But none of the free-to-air terrestrial broadcasters produce exclusive content for their online outlets. The VOD service is often the first distribution window ahead of the linear exposition, but all online-first content ends up in the broadcasting stream eventually. All these VOD and SVOD services serve as complements to linear television with heavy focus on catch-up and a deep catalogue of boxsets. HBO Max and Amazon Prime offers monthly or yearly subscriptions. Netflix and Viaplay offers monthly subscriptions exclusively. Streaming services launched by Polish linear operators are more flexible in terms of subscription models but still, in 2022, 65% of those who pay for VOD content prefer to do so via a monthly fee, instead of pay per and other deals.

Regulation

Broadcasting in Poland is governed through an operating license system and policies that concern content, regulate advertising and sponsored programming. But unlike linear TV, VoD services remain largely unregulated under the existing national regulatory frameworks and so far, there is very little regulation covering global players such as Netflix, especially in the domain of content. Recently implemented policies focus on remuneration and financial aspects. In July 2020, the Polish government introduced the so-called VOD tax or Netflix tax that requires on-demand services to contribute 1.5% of their revenues to the Polish Film Institute (PISF). Netflix is the largest contributor. Only providers whose customers account for fewer than 1% of internet users in Poland are exempt from the tax. In the first quarter of 2022, Polish Film Institute received more than PLN 7 million (USD1.5million).[7]

EU directives provide common European regulation that is also applicable in Poland. The latest review of the Audiovisual Media Services Directive in 2018 brought Netflix under EU regulation. The new rules increase the obligation to promote European works for VOD services which now need to have at least 30 percent share of European content in their catalogues. Poland is in the process (2022) of reviewing the law on communication services. The review also includes the transposition of the new AVMS directive into national legislation, which should happen in the near future.

In Poland, as elsewhere in Europe, the US dominance on the VOD market raises concern about the importance to protect authors’ right on their own creation and proportional remuneration to the exploitation of their work. This means that creative talent in Poland receives remuneration as a lumpsum payment and do not receive royalties from VoD players based on the success of their productions. The Directive on Copyright in the Digital Single Market (the DSM Directive) is a new piece of EU legislation that brings the copyright rules up to date with the realities of the online world. It aims to create a comprehensive framework, which will benefit a wide range of players acting in the digital environment, among them local creative talent. Articles 18-22 provide greater protection for content creators, including provision of information on how their works are exploited; additional claims for remuneration if the original payment was disproportionately low compared to the revenue generated from exploitation of the work; revocation of licences or assignments where their works are not being exploited; and a new alternative dispute resolution procedure to resolve matters. Content creators in Poland should now be recognised as authors and enjoy all the rights recognised by EU copyright law, including the new principle of appropriate and proportionate remuneration and collective rights management mechanism providing royalties on the exploitation of their works. So, even if screenwriters and directors in Poland transfer their exclusive rights to the VoD platforms, they should still in principle have a right to remuneration for the exploitation of their works. The Directive on Copyright in the Digital Single Market (the DSM Directive) came into force on 6 June 2019. Member states had until 7 June 2021 to implement the DSM Directive into their national law. However, not all EU member states have implemented the DSM Directive into their national law, Poland included.

Viewing Habits

According to Nielsen Media, in 2022 Polish “TV room viewers” (i.e., viewers of linear TV via a conventional TV set) watched television for an average of 4 hours and 30 minutes per person. 48% of Polish households have a smart TV set but only 35% of households have their TV devices actually connected to the Internet. This means that not all of smart TVs in Polish homes are used to their full functionality. Those users who do connect their TVs to the Internet are generally younger urban-dwellers with secondary or higher education. Users of connected TV sets, despite the availability of non-linear content, consume mostly linear TV. Of the overall time spent consuming content via connected TV sets, 85.8% is linear TV, whereas on-demand streaming only amounts to 6.6% - which consists of watching mainly Netflix (44.3%) and YouTube (32.7%). An average number of people streaming content on their Smart TVs every month is 13m, but only 300,000 stream via Smart TVs exclusively.

Polish users access VOD on various devices – mostly on laptops but smart TV users are a growing demographic. According to Wavemaker, in terms of devices used to access streaming content, in 2022 54% of streaming viewers relied on laptops as the main point of access, making laptops the most important tool for VOD streaming. Even though still significant, laptops are giving way to smart TVs. In 2022, 51% of people who streamed content, did so via their connected TV, which demonstrates a very dynamic growth from 43% in 2019. The third most often used tool for accessing VOD content are smartphones, but the VOD users rely on this tool less and less – only 39% of VOD users reported using smartphone for this purpose in 2022, marking a sudden drop from 2019, when this number was 45%.

The lack of advertising and the quality of available titles are important reasons for users to choose VOD over traditional television. The users also value the smooth functioning of the platforms and the relatively low price for the amount of content available. In 2020, according to Wavemaker, irritation with advertising on VOD services has reached a record level, equalling that of TV advertising. As many as 63% of Polish online viewers say that advertising on on-demand services bothers them.

Internet Pricing and Availability

The availability of Internet is not an obstacle for the delivery of streaming content. In 2021, 92.4 percent of Polish households had Internet access.

Poland is a price-sensitive market. Only one in four people interested in subscribing to Disney+ would do so if the monthly subscription fee exceeded 30 zł per month (7USD). Netflix’s packages are priced on accessibility; its basic membership package is PLN29 per month (7USD), ranging up to PLN60 (13USD) for the premium package. In comparison, Amazon Prime costs 10,99PLN (3USD) per month, HBO Max is 29,99PLN (7USD) per month, Viaplay is PLN34 (8USD) per month, and Disney+ is PLN28,99 (7USD) per month.

Content

The first global streaming service to enter the Polish market was HBO Go, which made its regional debut in Poland in December 2010. Considering its already established position in the Polish market, HBO Go was recognised by Netflix as their direct competition when entering the CEE region and the service developing the most comparable local content. Netflix entered the Polish market with a rich library of content, all with both Polish subs and voice-over.[8] For the Polish launch, Reed Hastings came to Warsaw for a publicity event and hailed Netflix’s launch in Poland as “a truly Polish service” with a fully localised user interface, with over 80% of its content being dubbed or subtitled in Polish.[9] Netflix’s strategy was different from HBO Go, which on its launch offered Polish language versions of only 800 movies and 200 series, extending its library offer gradually. Polish users were able to try Netflix for free for one month, charging Polish customers in local currency.

HBO Go began investing in local content since the 2014 premiere of highly acclaimed Polish series Wataha (The Pack), likely encouraging Netflix to similarly incorporate local content as a key strategy for the Polish market. Netflix’s first Polish original – the acclaimed alternative history drama 1983 (2018), a dystopian story of Poland in 2003 under communist rule that never ended, directed by four female directors including Agnieszka Holland. The second of Netflix’s Polish-language series was mystery thriller The Woods (W głębi lasu, 2020), first of two Polish-language adaptations of crime novels by American best-selling author Harlan Coben. Another of Coben’s TV adaptation, Hold Tight, which cast local stars Magdalena Boczarska and Leszek Lichota in the lead, hit Netflix in 2022. Polish production heavyweight ATM Group – the creative force behind HBO Europe’s first Polish original Wataha – is the local producer on both Coben series for Netflix. 2021 saw the release of Sexify – a teen drama about young female start-uppers creating a sex app and an uncompromising portrayal of sex among young adults and LGBTQ+-related topics, which are still a taboo in Poland’s mainstream media. Sexify is actually the first production in Poland to ever employ an intimacy coordinator. Due to large number of nudity and simulated sex, Netflix required the local producer to appoint an intimacy coordinator to ensure all the actors feel comfortable while shooting. Though intimacy coordinators have become standard in Hollywood, they are an entirely new film profession in Poland. Sexify reached top 3 in important markets such as France, Germany, Italy, Brasil and India and top 5 in Spain, Canada, Australia.[10] It has been considered an international success and renewed for season 2 to hit Netflix in 2022.

After Showmax – an international player operating out of South Africa with a strong focus on local content, including a satirical political Web series Ucho prezesa and the SNL Polska format - ended its operations in Poland in 2019, the service's best-rated original production The Mire (originally titled Rojst, 2018), was picked up by Netflix in 2019, who then renewed this political crime drama for its very well received season 2.[11] Titled The Mire ‘97 (2021), the show takes place twelve years after season one concluded and blends familiar crime drama conventions with revelatory themes for primarily non-Polish audiences. The mire in each season’s title refers to the bog-riddled forest surrounding a small town in Silesia – territory with a very complicated post-WWII history that the show addresses as a backdrop to an investigation into a mysterious death of a local teenager. The show, particularly its second season commissioned by Netflix, has been praised for its authentic portrayal of most notably the rise of democracy in the wake of the fall of the communist Iron Curtain of mid-1990s Poland. A transition-era Poland and the spirit of the 1990s was recreated in meticulous set and costume design, as well as cinematography, with soot-stained housing blocks and state-monopoly signage.[12] Netflix’s The Mire ‘97 was considered one of the best shows in 2021.[13] Season 3 begins filming in 2022.

A recent addition to Netflix’s local output in Poland is Cracow Monsters (Krakowskie potwory), a paranormal thriller coupled with urban fantasy based on Slavic mythology . The cinematography and production value of Cracow Monsters impresses thanks to Kasia Adamik – Agnieszka Holland’s daughter – who shares credit for creating and directing Cracow Monsters with Olga Chajdas, both of whom joined Holland in directing the 2018 Netflix series 1983 (the first Polish-language series for the streaming service) and both of whom worked on the HBO drama Wataha.

When it comes to Polish content, Netflix isn’t just betting on TV series but is equally committed to feature film commissions many of which turned out to be very successful. How I Fell In Love With A Gangster, for example, at one point, was the most popular foreign language film.[14] “365 Days” probably wasn’t the film Poland was hoping would be its global calling card but it is nonetheless the first Polish film to truly break through to become a worldwide, mainstream success.[15] This soft-core erotic thriller based on the Fifty Shades of Grey-style trilogy by Polish writer Blanka Lipińska, was released in early 2020, grossed $9 million at the Polish box office. Netflix then picked up global rights to 365 Days and released the film in June 2020; almost overnight, it became the world’s guilty pleasure. The film was one of Netflix’s top three most viewed releases in the U.S., U.K. and across most of Europe, as well as in India, Canada and New Zealand. Netflix commissioned two back-to-back sequels, the first of which hit the service in 2022.[16] Shortly after announcing plans to set up its East European hub in Warsaw, Netflix has doubled down on its Polish-language originals. The streamer revealed details of nine new Polish-language series and nine feature films that will roll out on its service throughout 2022 and 2023.[17]

Local commissioning of high-quality original exclusive content helps a service stand out in an increasingly crowded market. But local commissions are not the only strategy for generating content. Licensing of local ready-made content became a quick way for Netflix of gaining advantage in local market in Poland. In order to shore up the Polish content within its catalogue, Netflix has signed Poland-specific content deals[18] with several local distributors such as Next Film, Kino Świat, Alter Ego Pictures, allowing access to Polish films from distributors’ portfolios.[19] Netflix has also made a deal with thematic cable operator AXN Polska and offers AXN’s series Ultraviolet in its library. Netflix was also interested in gaining access to Poland’s terrestrial broadcasters’ extensive libraries of content. TVN, now part of Warner Bros. Discovery, rejected such collaboration immediately, as the broadcaster is devoted to developing VOD services of their own and securing their own exclusive content. While commercial broadcaster TVN refused to sell rights to any of its programming, public broadcaster TVP has been collaborating with Netflix. Although TVP has never revealed how much of its film and series rights it has handed over to the streaming giant as part of the deal, Netflix now includes back catalogues of popular Polish shows from the Polish public service broadcaster TVP,[20] such as 130 episodes of the cult series Ranczo[21], Artyści, Archiwista, 12 seasons of O mnie się nie martw and 3 seasons of Wojenne dziewczyny. These titles were available simultaneously on TVP's AVOD service, while Netflix's offer remains behind the pay wall. The collaboration between Netflix and Poland’s public service broadcaster TVP also involved a co-production of a historical crime series based on a bestselling novel Erynie by Marek Krajewski.[22] The deal determines that the show is set to premiere on Netflix as its first distribution window, then on TVP's VOD service, and finally on the linear channel. In 2022, the public broadcaster started betting on its own platforms and ceased licensing to Netflix.[23]

As of 2019, Poland offers a 30% cash rebate incentive to international producers of feature films, animation, documentaries and TV series that shoot locally in Poland. This well-funded and generous support system is meant to attract producers willing to cooperate with Polish partners and is expected to contribute to Netflix’s willingness to invest in Poland.[24]

Subscriber Estimates

Although linear and pay TV still dominate in Poland, Polish viewers are nonetheless among the most avid consumers of online video in Central and Eastern Europe: Poland boasts 4.3 million subs out of 14 million regionwide, according to Omdia. VOD is a young and fast-growing industry but not yet saturated and still has a lot of potential for the development of video-on-demand. According to Ampere Analysis, the overall penetration of streaming services in Poland is still at a relatively low level, not only compared to the US, but also to many Western European countries.[25]

According to a Mediapanel survey for Wirtualne Media, in February 2022, 14.35 million Polish users visited Netflix (web and mobile app), spending an average of 5 hours 39 minutes streaming, placing it firmly in top spot among VOD and OTT services.[26] The same study shows that in February 2022, Netflix had 10 million more users than HBO GO, where the average time spent was 1 hour and 30 minutes. Wirtualne Media notes that Netflix has been the most popular VOD and OTT service in Poland since the second half of 2019 and enjoyed particularly strong growth in 2021. According to Ampere Analysis, as quoted in Wirtualne Media, Netflix had 2,5 milion subscribers in Poland at the end of 2021.[27] However, many users share passwords with family, friends and even strangers, thus reducing the revenue available to Netflix from the Polish market.

Local Netflix Office

In 2022, Netflix announced that it is set to open an office in Warsaw to act as its regional hub for Central and Eastern Europe. In a blog post Larry Tanz, VP, head of original series, EMEA at Netflix, commented that “The Netflix office in Warsaw is a natural next step for us and will help build long-term cooperation in the region as well as deepen existing ties, creating new opportunities for content creators and producers. The creativity and potential of the local industry make Warsaw a great place to base our business across Central and Eastern Europe.”[28] According to the company’s own figures, in 2020-2021, Netflix invested more than 490 million PLN ($115 million) in Polish originals, creating 2,600 jobs in the process.[29]

Alongside these investments and commissioned productions, Netflix is now in the third year of what has been described as a “multi-stage” cooperation with the Polish Producers Alliance (KIPA). It began in May 2020 with the creation of an assistance fund for the neediest TV and film industry employees affected by the suspension of productions during the early stages of the Covid lockdown, filling the funding gaps and helping producers and distributors stay afloat. In spring 2020 alone, Netflix spent 2.5 million PLN for this support initiative and has since also launched a training series for those planning to work in the audiovisual industry.[30] As of 2022, Netflix began long-term cooperation with the world-famous Lodz Film School.[31] This collaboration is part of the international Netflix Grow Creative programme and it includes discovering and training young talents, enabling them to successfully launch a career in the film industry.

Another display of Netflix’s attachment to Poland in their long-term strategy in the region, is hiring a group of managers from Poland. At the end of 2018, the position of content acquisition manager for Central Europe was filled by Łukasz Kłuskiewicz to acquire local content in Central European countries, mainly in Poland, Romania and Hungary. As CEE content acquisition manager, he also handles cooperation with local content providers, broadcasters, distributors and producers. From 2008 to 2016, Kłuskiewicz worked at TVP – Poland’s public service broadcaster.[32] In spring 2020, Netflix established the position of Director, Local Language Originals, CEE, currently occupied by the former HBO Poland producer Anna Nagler. In her new position, Nagler oversees the development and production of Netflix productions in the CEE region. Previously, Nagler worked for HBO and supervised the development of Polish originals Pakt, Wataha, and Bez tajemnic.[33] Marketing and PR departments are equally staffed with Polish personnel - Communications Manager CEE is former Google employee Anna Żur (azur@netflix.com) and Agata Burdzy serves as Originals Publicity Manager for Poland and the CEE region (aburdzy@netflix.com). All CEE staff is currently residing in the Amsterdam headquarters, with a prospect of relocation to Warsaw once the local hub is ready. Complimentary to Amsterdam-based employees for the CEE region, Netflix is collaborating with Warsaw office of the global public relations firm MSL Global to deal with local communications and publicity[34] and global media agency Wavemaker to service and deliver full-funnel marketing.

Industry Reaction

Since launch, Netflix has considered Poland as an important part of the CEE market and created a constant demand for domestic content, therefore, contributing to a lively production sector. Yet, Netflix’s increasing presence, as well as importance, in Poland’s creative industry has been raising various concerns.[35] With the new Netflix office in Warsaw and other streaming platforms already beginning to emulate Netflix’s strategy of commissioning new scripted content in Poland, there could not be a better time to be a Polish content creator. But local entities might be struggling to compete. Over the next few years, Netflix alone is set to be better funded than the leading commercial broadcasters or Poland’s independent producers, and its scale means that it is able to produce quantities of high-quality content that most of its local competitors cannot match. Joanna Szymańska, producer at Warsaw-based ShipsBoy responsible for Netflix’s Hiacynt, is quoted saying that “it is already very difficult to secure key talents and crew, as the volume of Netflix-financed productions increases. So the budgets will probably go up, too, and the competition between producers will be even tougher. But I believe it is for the better. [One] positive side of the platforms is that they are enforcing change in quality of work: intimacy coordinators, code of ethics etc. That is still a novelty on Polish sets.” Alicja Grawon-Jaksik, president of the board of the Polish Producers Alliance worries that local producers may become too dependent on streaming cash and believes that Poland needs to keep, and strengthen, its public funding system to create a sustainable business model whereby independent producers can retain some rights to their work and be in a position to make fair deals with the streamers.[36] The issue of royalties remains a controversial one. When Netflix bought the licence to stream all seasons of TVP’s hugely popular TV series Ranczo, its creators were not remunerated as, at the time, there were no legal requirements placed upon Netflix or any other streaming platform to pay out royalties to local creative talent.[37] EU Member States had until 7 June 2021 to implement the Directive on Copyright in the Digital Single Market into their national legislation, but, as of 2022, Poland has not yet finalized this process.

Political Bias

Netflix’s operations in Poland have generated not only interest from the representatives of the governing right-wing party PiS but also caused varied reactions and viewpoints, especially in recent years when Netflix secured a strong position in the Polish market. On the one hand, the public service broadcaster TVP (strongly steered politically by the ruling party) collaborated closely with Netflix, not only selling distribution rights to many of its feature films and TV series in 2019 but also began the co-production of TV adaptation of a Polish novel Erynie. In 2021, Jacek Kurski – the president of TVP and a strong proponent of the right-wing government publicly expressed praise for Netflix and spoke very fondly their mutually beneficial collaboration and the streamer’s successful business model.[38] Despite this obvious bond between TVP and Netflix, representatives of the ruling party did not spare their criticism about streamer’s content. Netflix’s original Polish language feature film W lesie dziś nie zaśnie nikt 2 generated a lot of public criticism from Polish politicians for the film’s depiction of the Territorial Defense Forces soldiers – one of the hallmarks of PiS governments. Netflix’s commission portrays soldiers as incompetent and drunk on duty, incapacitated to fulfil their responsibilities, additionally associating them with a swastika symbol.[39]

In 2020, Deputy Infrastructure Minister Marcin Horała, while commenting on the movement Strajk Kobiet (Women's Strike), that has worked relentlessly to stop the various initiatives proposing an almost complete ban on abortion in Poland, expressed an open criticism of Netflix. American streamer was blamed for promoting liberal-leftist sentiments that led to the social unrest and for undermining the authority of church, the institution of family and Poland as a homeland.[40] Elsewhere Kamil Bortniczuk criticised Netflix for engendering leftist mindsets and promoting LGBTQ+ sentiments, encouraging people to protest against Netflix and send criticism via social media. In 2020, Polish Deputy PM Jarosław Gowin addressed the head of Netflix on Twitter to remove The First Temptation of Christ from its library for its portrayal of Jesus as homosexual. Gowin encouraged Internet users to sign an online petition for the show to be removed from the Netflix platform for offending the religious beliefs of Christians.

In 2022, the collaboration between Netflix and TVP was suddenly put on hold with no public statement from either party.[41] Yet, at the same time, Piotr Muller. the government rep, publicly expressed joy that Netflix is set to make Warsaw its regional hub for CEE as this is going to create new opportunities for the local creative talent, more jobs as well as investment in Poland.[42]

Notes

[1] https://www.wirtualnemedia.pl/artykul/najpopularniejsze-seriale-wiedzmin-gra-o-tron-wataha-dom-z-papieru-chylka

[2] https://www.wirtualnemedia.pl/artykul/hbo-max-netflix-jak-korzystac-ile-kosztuje-oferta-disney

[3] https://www.wirtualnemedia.pl/artykul/hbo-max-netflix-jak-korzystac-ile-kosztuje-oferta-disney

[4] https://www.broadbandtvnews.com/2010/12/17/hbo-launches-broadband-vod/

[5] https://www.broadbandtvnews.com/2018/03/26/hbo-go-opens-up-in-poland/

[6] https://grupapolsatplus.pl/en/about-us/our-business/online-video

[7] https://www.wirtualnemedia.pl/artykul/podatek-od-vod

[8] https://media.mslgroup.pl/3087/pr/327038/netflix-juz-po-polsku

[9] https://www.broadbandtvnews.com/2016/09/20/netflix-goes-local-poland/

[10] https://www.wirtualnemedia.pl/artykul/serial-sexify-hit-netflix-gdzie-opinie-fabula-aktorzy

[11] https://www.wirtualnemedia.pl/artykul/rojst-97-netflix-recenzja

[12] https://www.wirtualnemedia.pl/artykul/rojst-97-netflix-recenzja

[13] https://www.wirtualnemedia.pl/artykul/najlepsze-polskie-seriale-2021-roku

[14] https://www.polityka.pl/tygodnikpolityka/kultura/2152516,1,jak-pokochalam-gangstera-w-czolowce-netflixa-skad-ten-fenomen.read

[15] https://www.hollywoodreporter.com/business/business-news/poland-production-paradise-netflix-streaming-age-1234978583/

[16] https://www.hollywoodreporter.com/business/business-news/poland-production-paradise-netflix-streaming-age-1234978583/

[17] https://www.hollywoodreporter.com/tv/tv-news/netflix-polish-originals-lineup-1235128684/

[18] https://www.broadbandtvnews.com/2020/06/02/odmedia-makes-polish-netflix-move/

[19] https://www.wirtualnemedia.pl/artykul/filmy-z-portfolio-next-film-agora-w-bazie-netflix-kolejny-wazny-partner

[20] https://www.wirtualnemedia.pl/artykul/tvp-netflix-umowa-jacek-kurski-chcemy-miec-quasi-netfliksowska-oferte-konsumpcji-mediow

[21] https://www.wirtualnemedia.pl/artykul/ranczo-netflix-aktorzy-bez-tantiem-jest-odpowiedz-tvp

[22] https://www.wirtualnemedia.pl/artykul/serial-erynie-tvp-wspolpraca-netflix-obsada-opinie-premiera-zdjecia-na-zaawansowanym-etapie

[23] https://www.wirtualnemedia.pl/artykul/jak-ogladac-seriale-tvp-netflix-ranczo-archiwista-artysci-koniec-umowy

[24] http://kipa.pl/en/financial-incentives-for-audiovisual-production-in-poland/

[25] https://www.wirtualnemedia.pl/artykul/jakie-serwisy-streamingowe-w-polsce-ceny-oferta-jak-zamowic-liczba-uzytkownikow

[26] https://www.wirtualnemedia.pl/artykul/hbo-max-w-polsce-jak-pobrac-oferta-cena-najpopularniejsze-platformy-vod

[27] https://www.wirtualnemedia.pl/artykul/jakie-serwisy-streamingowe-w-polsce-ceny-oferta-jak-zamowic-liczba-uzytkownikow

[28] https://about.netflix.com/en/news/netflix-bets-on-central-and-eastern-europe

[29] https://www.broadbandtvnews.com/2022/04/01/chris-dziadul-reports-netflix-opts-for-poland/

[30] https://about.netflix.com/en/news/netflix-bets-on-central-and-eastern-europe

[31] https://www.filmschool.lodz.pl/en/news/2030,netflix-ze-szkola-filmowa-w-nbsp-lodzi.html

[32] https://www.wirtualnemedia.pl/artykul/lukasz-kluskiewicz-z-fox-networks-group-do-netflix

[33] https://www.wirtualnemedia.pl/artykul/anna-nagler-odpowiada-za-lokalne-produkcje-netflix-director-of-local-language-originals

[34] https://media.mslgroup.pl/3087/contact

[35] https://www.hollywoodreporter.com/business/business-news/poland-production-paradise-netflix-streaming-age-1234978583/

[36] https://www.hollywoodreporter.com/business/business-news/poland-production-paradise-netflix-streaming-age-1234978583/

[37] https://www.wirtualnemedia.pl/artykul/ranczo-netflix-aktorzy-bez-tantiem-jest-odpowiedz-tvp

[38] https://www.wirtualnemedia.pl/artykul/tvp-netflix-umowa-jacek-kurski-chcemy-miec-quasi-netfliksowska-oferte-konsumpcji-mediow

[39] https://www.wirtualnemedia.pl/artykul/netflix-film-w-lesie-dzis-nie-zasnie-nikt-2-obraza-wojska-obrony-terytorialnej-horror-pis

[40] https://www.wirtualnemedia.pl/artykul/netflix-film-w-lesie-dzis-nie-zasnie-nikt-2-obraza-wojska-obrony-terytorialnej-horror-pis

[41] https://www.wirtualnemedia.pl/artykul/jak-ogladac-seriale-tvp-netflix-ranczo-archiwista-artysci-koniec-umowy

[42] https://www.wirtualnemedia.pl/artykul/netflix-biuro-w-warszawie-hub-europa-srodkowo-wschodnia