Sweden

Contributed by Chris Baumann

August 2017

Key Takeaways

Given its small size, high demand for streaming video, and strong digital infrastructure, Sweden is particularly well-suited to the Netflix model.

Swedish viewers continue to prefer free video services (this includes YouTube and catch-up services as much as unauthorized platforms like SweFilmer) over paid ones, but Netflix and other SVOD platforms are gaining momentum.

Netflix is by far the most popular SVOD platform in Sweden, and its popularity is only matched by YouTube.

The local catalogue has drawn criticism after Netflix’s launch in Sweden, particularly for its lack of licensed local content.

Market

Netflix launched in Sweden in October 2012. The entry in Sweden was relatively low-key and did not include much advertising and marketing, besides partnering with the Swedish streaming music service Spotify for a campaign that offered existing Spotify Premium subscribers a free Netflix subscription for the rest of 2012.

Netflix launched into an oversaturated media landscape. Despite its size (around ten million people) and location (in the periphery of Europe), Sweden is host to a plethora of local and offshore video streaming platforms. Viewers can choose between video streaming options from public service and commercial broadcasters, pay TV operators, and telecommunications companies alongside subscription-based, transactional, and advertising-supported streaming services, and a growing number of unauthorized alternatives.

Local video streaming platforms are predominantly in the hands of four media companies that dominate the Swedish television market: the public service broadcaster Sveriges Television, as well as its commercial counterparts Modern Times Group, TV4 Group, and SBS Discovery Media. These companies provide catch up TV services in addition to their free-to-air offerings, making previously broadcast programs available to stream for a limited time. Most notable here are SVT Play, Viafree, TV4 Play, as well as Kanal 5 Play. In addition to these free services, the major commercial networks also offer subscription-based video streaming platforms that function as online extensions to traditional pay TV services, such as Viaplay, C More, and Dplay. Furthermore, viewers have the possibility to subscribe to aggregator streaming services such as Magine TV or Telia Play Plus, which package content from several public service and commercial broadcasters, as well as pay TV operators. Finally, there are transactional video streaming platforms, such as SF Anytime, and Plejmo, that allow viewers to purchase movies and television shows, or rent them for a limited time (usually 48 hours). Popular offshore video streaming platforms, besides Netflix, include YouTube as well as Time Warner’s HBO Nordic. The latter is a standalone subscription video streaming service that offers access to the entire HBO library, including the company’s latest television episodes twenty-four hours after they have been broadcast in the United States.

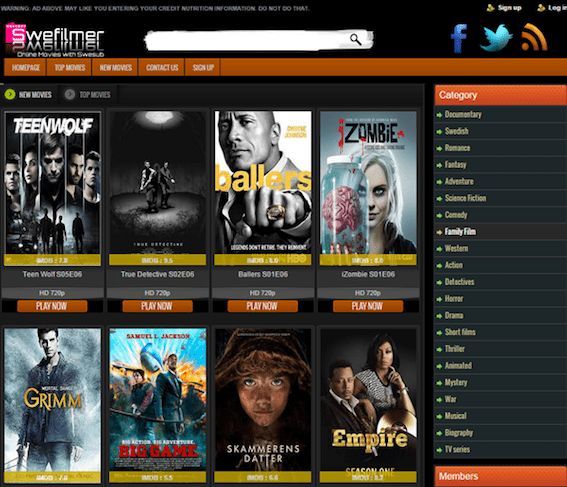

In addition to the many authorized local and offshore video streaming options, there are an increasing number of unauthorized services competing for the attention of Swedish viewers. Probably the most visible of them are SweFilmer and The Pirate Bay. SweFilmer is a website that provides free streams of thousands of pirated movies and television shows. Swefilmer has attracted considerable public attention, and copycat websites such as Dreamfilm and Sweflix have imitated its model.[1] In 2016, the infamous Swedish torrent site The Pirate Bay added support for Torrents Time, a plugin that lets users stream torrents directly inside their browsers.

The popularity of streaming video services, particularly Netflix and YouTube, continues to increase in Sweden. The local market research firm Mediavision estimates that Swedes aged 15-74 spent more time watching Netflix and YouTube than most linear TV channels in 2015. Moreover, around 35 percent of Swedish households subscribed to one or more video on demand services.

Regulation

Given Sweden’s comparatively strong digital infrastructure and historically laissez-faire approach towards internet use and censorship, it is easy to see why the country is often described as the prototypical cyberlibertarian information economy. On the eve of Netflix’s Swedish launch, Netflix CEO Reed Hastings told journalists that “the Nordic countries constitute one of the most advanced markets for new services and technologies, and particularly Sweden…both for its high broadband speeds and its people who tend to be early adopters.” It is hardly a coincidence that Sweden became one of Netflix’s first markets outside of the Americas (only the UK and Ireland came earlier).

The arrival of Netflix has not been particularly significant for Swedish internet policy debates. Given the country’s strong internet infrastructure, the Swedish Netflix experience has from the outset mostly been free from the capacity problems and slow speeds that are commonplace in other countries. In addition to investing heavily in fiber optic wires, Swedish internet service providers have been quick to adopt Netflix’s Open Connect program, a globally distributed content delivery network, and installed proprietary Netflix appliances in their data centers. Swedish ISPs often market their internet offerings based on the Netflix experience they can offer their customers, in their ads sometimes referring to their performance in Netflix’s ISP Speed Index.

Viewing Habits

Swedes have a wide variety of screens at their disposal. More than 92 percent of Swedish households have access to a computer, 81 percent to a smartphone, and 65 percent to a tablet.[2] In 2015, 34 percent of all Swedes used their tablet to watch TV, film, or video.[3] The great majority of Swedish viewers now have smart TVs in their living rooms, however, only 23 percent of the population (around 1.7 million people) actually connected their smart TVs to the internet to make use of the built-in apps in 2016 (in Sweden, smart TVs usually ship with pre-installed apps by Netflix, YouTube, HBO Nordic, Viaplay and C More).

Internet Pricing and Availability

The internet did not spread particularly quickly in Sweden during the 1990s, at least not compared to a country like the United States where it was originally conceived. However, both broadband penetration and speeds continue to increase in Sweden while leveling out in many OECD countries. The Scandinavian country ranks third in the World Economic Forum’s Networked Readiness Index for 2016.[4] Today, 93 percent of the Swedish population has access to the internet, a number that increases to 97 percent in the age group 16 to 54.[5] Broadband is available in 91 percent of Swedish households, with 67 percent of homes and enterprises having access to downstream connections of at least 100 Mbit/s.[6] Yet, despite these numbers, prices for fixed broadband remain comparatively low in Sweden. With true fiber connections costing from SEK 182 per month, the country ranks cheapest globally for internet connections of 100 Mbit/s or more.[7]

As promising as this arrangement appears from a corporate perspective, however, it has surprisingly not resulted in any sizable consumer spending on subscription or transaction-based video streaming services. Swedes are generally open towards making their purchases online, with 90 percent of internet users regularly buying and paying for items or services via the internet.[8] Yet, whereas purchases of home electronics or clothes over the internet have surged in recent years, sales of digital media have not contributed nearly as much.[9] The numbers are somewhat improving in the music sector, where Spotify, in particular, has helped to increase the number of users paying for music online from 15 percent in 2011 to 44 percent in 2016.[10] In the online video sector, however, consumer spending is a bit lower as the majority of content is still accessed for free. Around 38 percent of all Swedish internet users subscribed to a video streaming service in 2016.[11]

Content

At launch, Netflix was criticized by Swedish viewers for its catalogue that to many felt like a watered-down version of the US catalogue. While Netflix does not publish data on the size of its Swedish catalogue, it has been estimated that it was around 3000 titles at the time of the local launch in October 2012. Although the total number of available titles on Netflix was comparable to what popular Swedish VOD services (like Viaplay and SF Anytime) offered at the time, licensed local content was few and far between (less than 100 titles) and could, at least initially, mostly be found in the kids’ section. The number of local titles has since improved somewhat.

Consumers and the Press Reaction

Consumers and the press were generally excited about Netflix becoming available in Sweden, with many newspapers reporting on the launch of the service and publishing specials on VOD services on Sweden. This excitement petered out somewhat after the launch with consumers and the press both pointing out the perceived holes in Netflix’s Swedish catalogue.

Nevertheless, the price point (SEK 79) was widely seen as reasonable for the offering, especially compared to its closest competitor Viaplay, which, depending on the package, could cost almost three times as much at the time. Netflix has since managed to outgrow its competitors and is by far the most popular VOD service in Sweden today.

Subscriber Estimates

Netflix has not made any official data on subscriber numbers available. However, Mediavision estimates that in 2016 Netflix reached more than 1 million Swedish viewers (about ¼ of Swedish households with viewers aged 15-74), making it the most popular SVOD platform in the country ahead of Viaplay and HBO Nordic.

Local Netflix Office

There are no Netflix offices in Sweden.

Notes

[1] In 2012, “swefilmer” was the third-most searched term on google.se, according to Google Trends.

[2] Olle Findahl, Svenskarna och internet 2016, Stockholm, 2016.

[3] Olle Findahl, Svenskarna och internet 2015, Stockholm, 2015.

[4] World Economic Forum, The Global Information Technology Report 2016, Geneva, 2016.

[5] Statistiska Centralbyrån, Privatpersoners användning av datorer och internet 2016, Stockholm, 2014.

[6] Findahl 2016; PTS, PTS bredbandskartläggning 2015: En geografisk översikt av bredbandstillgången i Sverige, Stockholm, 2015.

[7] PTS, PTS prisrapport 2015: Prisutvecklingen på mobiltelefoni och bredband, Stockholm, 2014.

[8] Findahl, Svenskarna och internet 2016.

[9] PostNord, Svensk Digital Handel, and HUI Research, E-barometern 2016, Stockholm, 2016.

[10] Findahl, Svenskarna och internet 2016.

[11] Ibid.