Mexico

Contributed by Juan Llamas-Rodriguez

Updated October 2017

Key Takeaways

Mexico is the second-largest VOD market in Latin America, generating close to 35 percent of the market revenue.

Netflix debuted in Mexico in fall 2012. The lack of regulatory mechanisms for OTT services allowed for the service’s quick adoption, but the country’s low broadband penetration has stifled sustained expansion.

The two main competitors in the SVOD market, Clarovideo and Blim, come from Mexico’s homegrown monopolies, América Móvil and Televisa, respectively.

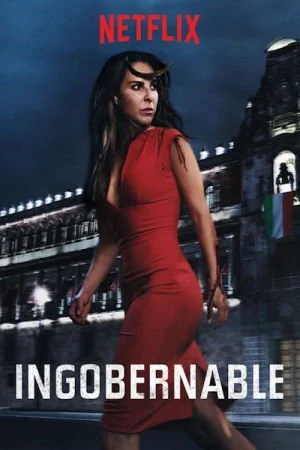

Netflix’s original series in Mexico, Club de Cuervos and Ingobernable, as well as its co-productions with U.S. Spanish-language networks have proven widely popular.

Market

Netflix arrived in Mexico on September 12, 2012, as part of the company’s Latin American expansion. It originally cost $99 MXN (around $7.50 USD at the time). By the end of 2016, it had a three-tiered pricing scheme: $99 MXN for one streaming device in standard definition, $109 for two streaming devices on high definition, and $149 for up to four devices in high definition.

In 2016, Netflix’s two main competitors in the Mexican market were homegrown: Clarovideo, from telecommunications firm América Móvil, and Blim, owned by television conglomerate Televisa. Being tied to one of Mexico’s existing media powerhouses provided a point of advantage, but neither competitor has managed to rival Netflix’s reach. While at least 50 percent of the country’s SVOD users have a Netflix account, only 40 percent or less report having either Clarovideo or Blim. (For the most part, studies fail to account for whether users have multiple subscriptions.)

Debuting months after Netflix in 2012, Clarovideo has been its closest competitor. In 2015, Netflix and Clarovideo had the SVOD market split 55 percent to 40 percent, respectively. Clarovideo has been able to maintain its status as the number two SVOD service in large part because it belongs to América Móvil, the telecommunications firm that also owns the country’s largest telephone and internet service provider (ISP), Telmex. Clarovideo is often included in consumer bundles when signing up for Telmex’s unlimited internet plans. The SVOD also allows consumers to buy or rent recently released U.S. and Mexican films and to subscribe to add-on channels such as HBO and Fox. When it launched Blim in 2016, Televisa pulled its content from Netflix and deprived the latter of the rights to stream popular telenovelas from the U.S. networks Telemundo and Univision. Although it no longer carries Televisa’s original content, Netflix nonetheless has renegotiated a streaming deal for subsequent seasons of Telemundo’s telenovelas and has begun co-production agreements with Univision for original content.

By 2017, there were over ten different SVOD services operating in Mexico, including Amazon Prime, HBO Go, and Dish OTT.

Regulation

Netflix moved into Mexico as the country was in the midst of regulatory changes for the broadcasting and telecommunications industries. The Federal Law on Telecommunications and Broadcasting instituted in July 2014 and the formation of the autonomous Instituto Federal de Telecomunicaciones were intended as measures to ensure the opening of markets within the country’s two longstanding oligopolies. Such regulatory changes did not impact Netflix directly since they include no mention of OTT services. Although there are limitations to foreign investment in broadcasting, Netflix remains exempt from these as a SVOD company. Instead, the regulatory moves towards greater telecommunications competition has spurred an initial growth in internet penetration, which may allow Netflix to expand into more households.

Internet Availability

Absent any regulatory mechanisms for content or investment, the biggest hurdle in Netflix’s expansion in Mexico has been the low penetration of broadband internet across the country. Statistics from UNESCO’s Broadband Commission reveal that only 12 percent of the population has access to fixed broadband, although 58 percent had access to mobile broadband as of the end of 2016. However, these percentages have been rising steadily over the past three years. The entry of new internet service providers into the market may allow for even greater rise in broadband penetration. An August 2017 study from The Competitive Intelligence Unit revealed that Netflix registered 7.4 million subscribers in the second trimester of 2017, an increase of 25 percent from the previous year and twelve times the number of subscribers that the service had in its first year in the country.

Viewing Habits

According to a 2016 survey from the Instituto Federal de Telecomunicaciones, almost 98 percent of Mexican homes own a television, but almost fifty percent of those only use it for watching broadcast channels. Cable subscriptions remain the dominant form of viewership for the other fifty percent, particularly since most subscribers rely on cable to watch sports events. Only 26 percent of those surveyed indicated a significant consumption of online video, with YouTube ranking in first place followed by Netflix. Although most consumers of online video declared watching at home, mobile devices were the primary mode for accessing this type of content. Despite these differences across the entire population, other studies have also shown that, among those consumers who regularly access online video content, less than half indicated that they still watched broadcast television and only a third admitted to watching cable. These changes in viewing habits may continue as internet penetration increases beyond urban areas.

Netflix has produced two original series for the Mexican market, both from recognizable creatives in Mexican film and television. Club de Cuervos was created by Gary Alazraki, director of the Mexican box office hit Nosotros Los Nobles (2013), and features Luis Gerardo Mendez, the film’s star. It was the first Spanish-language Netflix original series and, according to a social media study by Parrots Analytics, it was the most popular series out of thirty SVOD originals in Mexico during 2017. Its third season premiered on September 29, 2017. The second original series is Ingobernable (2017), featuring Mexican TV starlet Kate del Castillo. In addition, del Castillo’s biographical series The Day I Met El Chapo, about her relationship with Mexican drug cartel leader Joaquin “El Chapo” Guzman Loera, premiered exclusively on Netflix in October 2017. Netflix also co-produced El Chapo (2017) with Univision, a Spanish-language series based on Guzman Loera, which debuted on Netflix after airing on Univision during summer 2017.

Managing language and translation options has been a feature of Netflix’s global expansion, and its entry into Mexico allowed for the service to prepare its content for other Spanish-language markets. By 2012, Netflix offered Spanish subtitles to its entire non-children’s catalog. At the same time, many of Netflix’s original English-language series, such as House of Cards, are dubbed to Spanish in Mexico. Children’s content, such as the catalog of Disney features and television series that debuted on Netflix starting in fall of 2016, are dubbed.

Netflix owned the streaming rights in Mexico for telenovelas from Mexican network Televisa and the U.S. networks Univision and Telemundo until early 2016. According to Kari Perez, PR representative for Netflix Latin America, these telenovelas were among its most popular content in the years before that. The launch of Televisa’s own streaming service Blim in 2016 meant that Netflix lost access to all original Televisa content and some of its Telemundo content. Following a contentious ad campaign, Netflix renegotiated a streaming deal with Telemundo for subsequent seasons of the network’s popular telenovelas, such as El Señor de los Cielos.

Subscriber Estimates

Estimates on the number of Netflix subscribers places it at 4.7 million in mid-2017, according to one study by the consulting firm The Competitive Intelligence Unit (CIU). Since 7.4 million Mexicans admitted to subscribing to at least one SVOD service that year, this suggests Netflix’s market share is around 64 percent of the SVOD market in Mexico. However, these metrics should be understood as merely incomplete estimates. While CIU’s studies marked Netflix’s market share at 69 and 72 percent in 2016 and 2015, respectively, other firms such as Dataxis put it at 56 perfect in 2015. Though exact percentages vary depending on the firm carrying out the study, since 2015 all reports have placed Netflix’s share at around 60 percent of the total SVOD market in Mexico.

Local Netflix Office

Most operations, including content development and marketing, for the Mexican market are run out of Netflix’s Los Angeles office.

Suggested reading

Elia Margarita Cornelio-Mari, “Digital Delivery in Mexico: A Global Newcomer Stirs the Local Giants,” in The Age of Netflix, edited by Cory Barker and Myc Wiatrowski. Jefferson, NC: McFarland, 2017.

Anna Marie de la Fuente, “Televisa Takes on Netflix,” Variety, February 23, 2016.

Instituto Federal de Telecomunicaciones, “Statistical Yearbook 2015,” August 2016.

OECD, “Telecommunication and Broadcasting Review of Mexico 2017,” August 31, 2017.